NewsRental Market Mid-Year Update 2025

Below are a few highlights from reports we found interesting as well as our comments.

CMHC 2025 Mid-Year Rental Market Update:

https://www.cmhc-schl.gc.ca/observer/2025/2025-mid-year-rental-market-update

Published July 8, 2025, CMHC’s mid-year update shows some trends that rental market participants have been seeing over the past year.

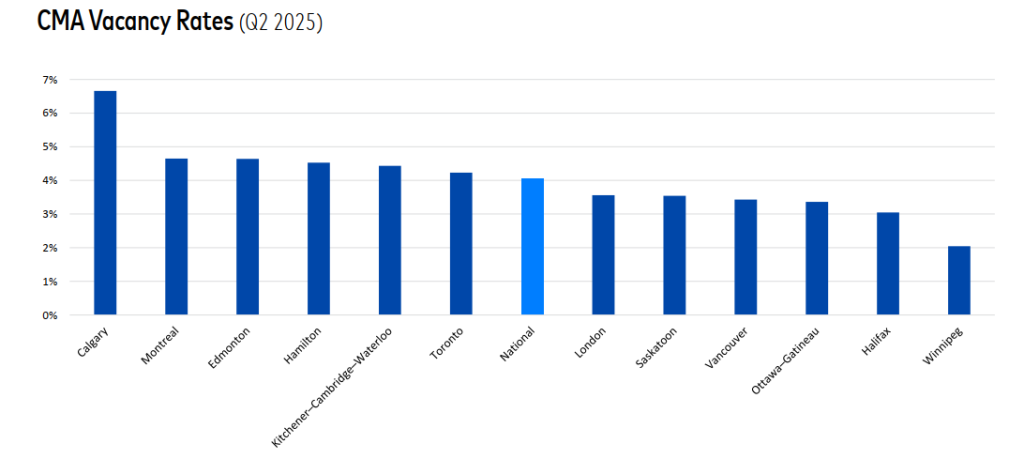

Increased rental supply leading to slightly higher vacancies and lower asking rents.

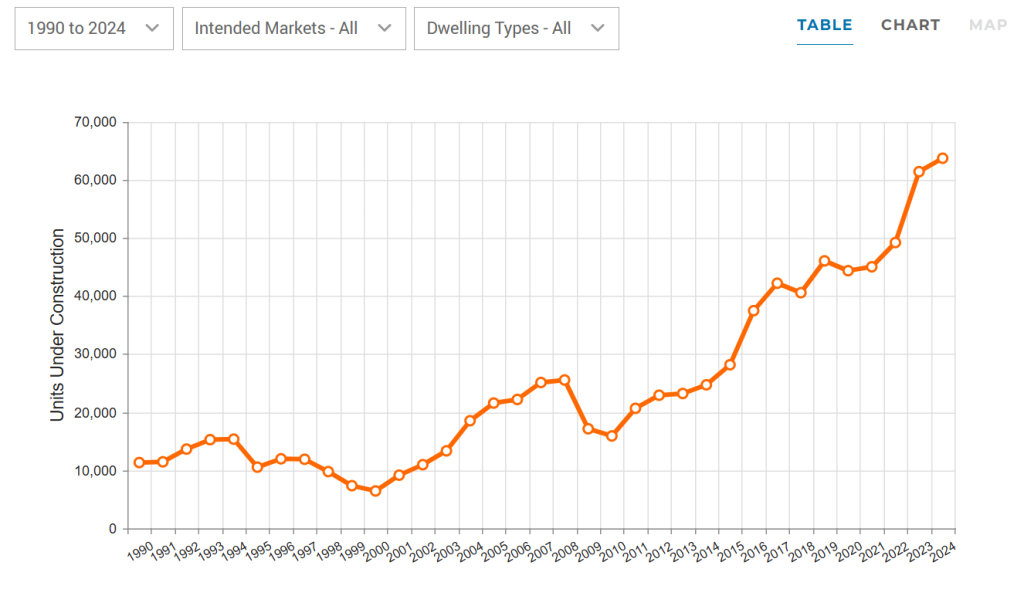

This is likely to continue as major metro regions still have a historically high amount of units under construction. CMHC chart for all housing under construction in Greater Vancouver below:

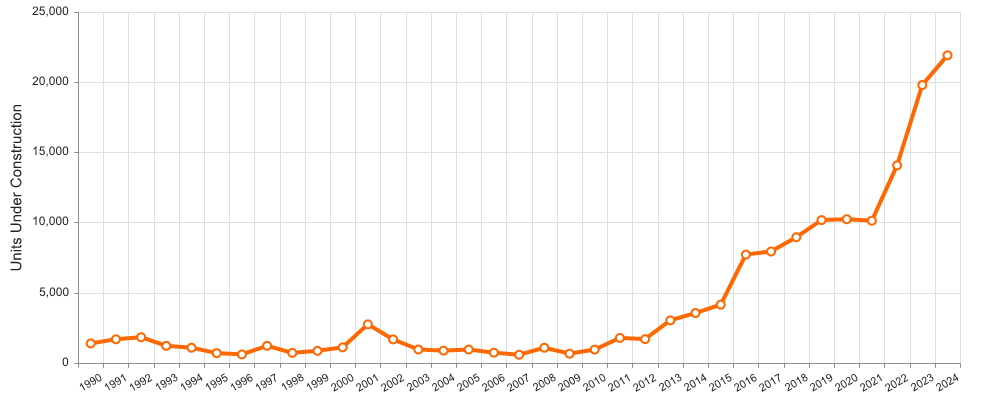

And for Rental housing:

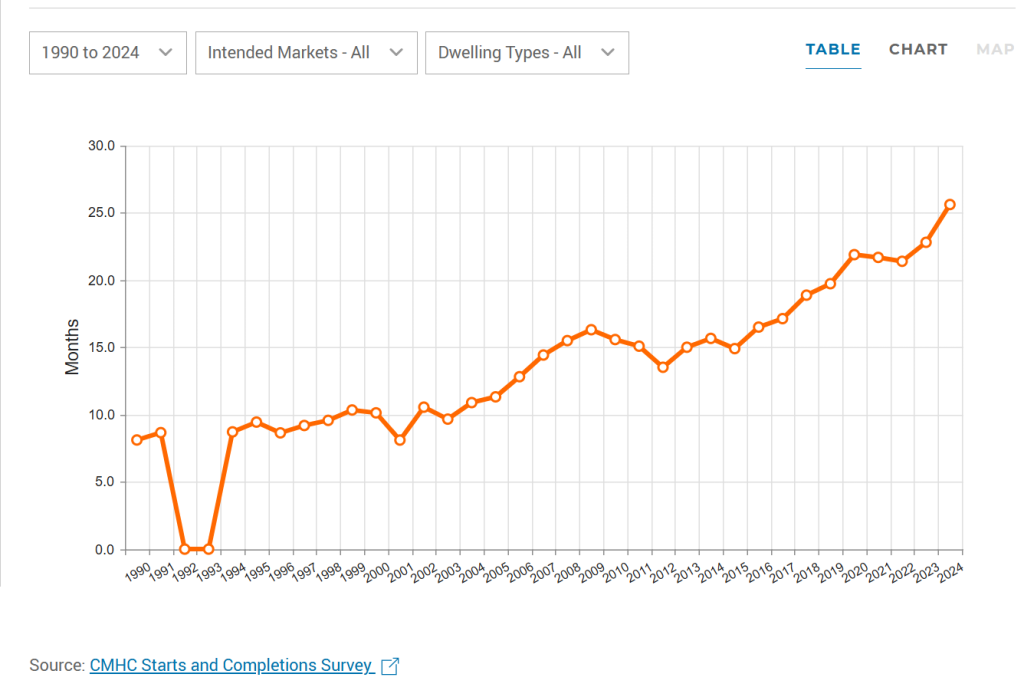

While the number is fairly large it’s important to note that timelines for constructions have increased over the last 2 decades due to increased size and complexity of projects.

Length of construction Greater Vancouver:

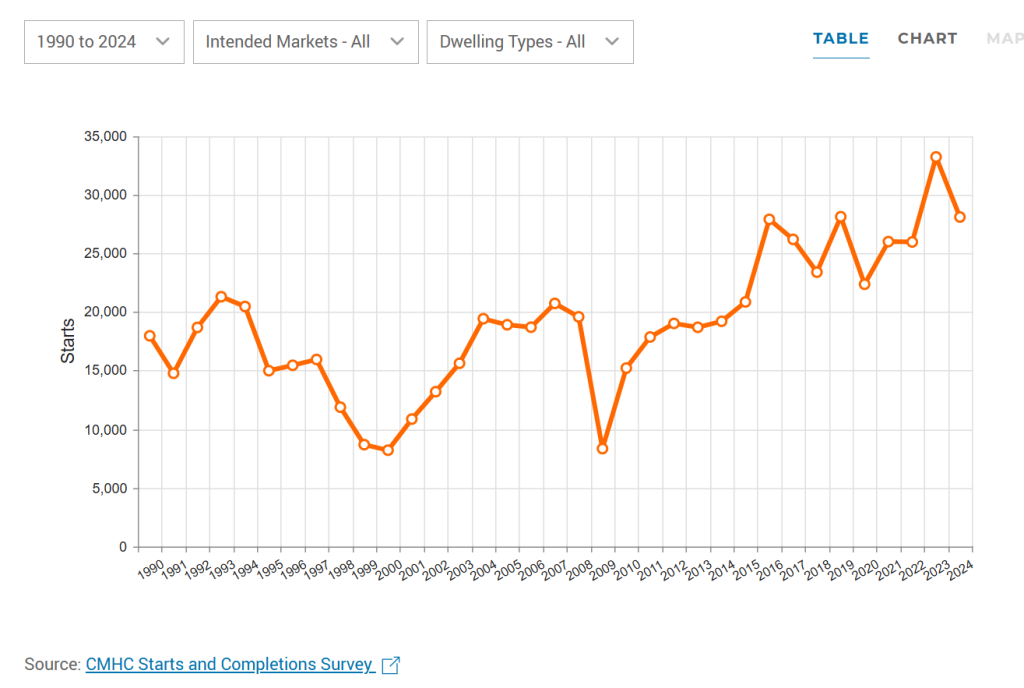

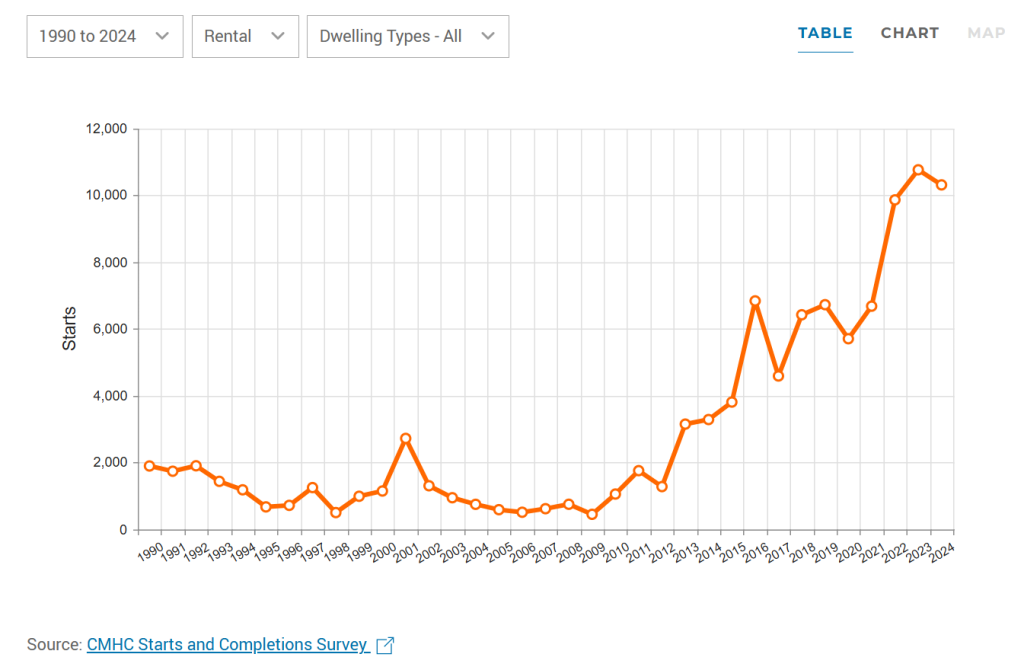

When looking at starts data, the biggest increase appears to be in Rental Housing starts.

While Greater Vancouver All Dwelling starts are up:

… The difference in rentals is far more pronounced:

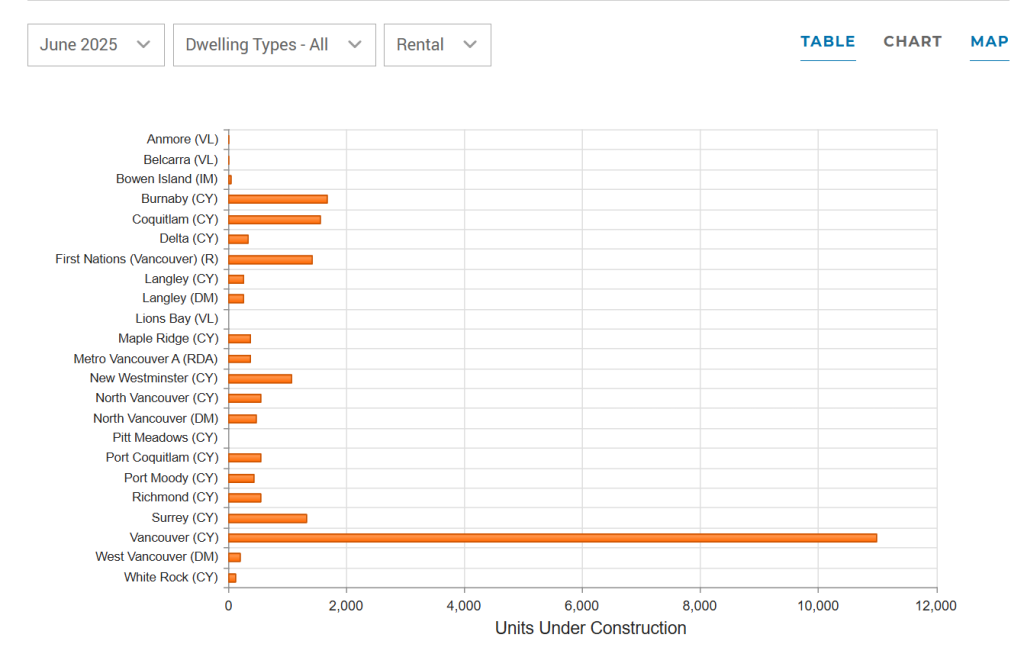

There are some differences regionally. Vancouver has the greatest amount of rentals under construction:

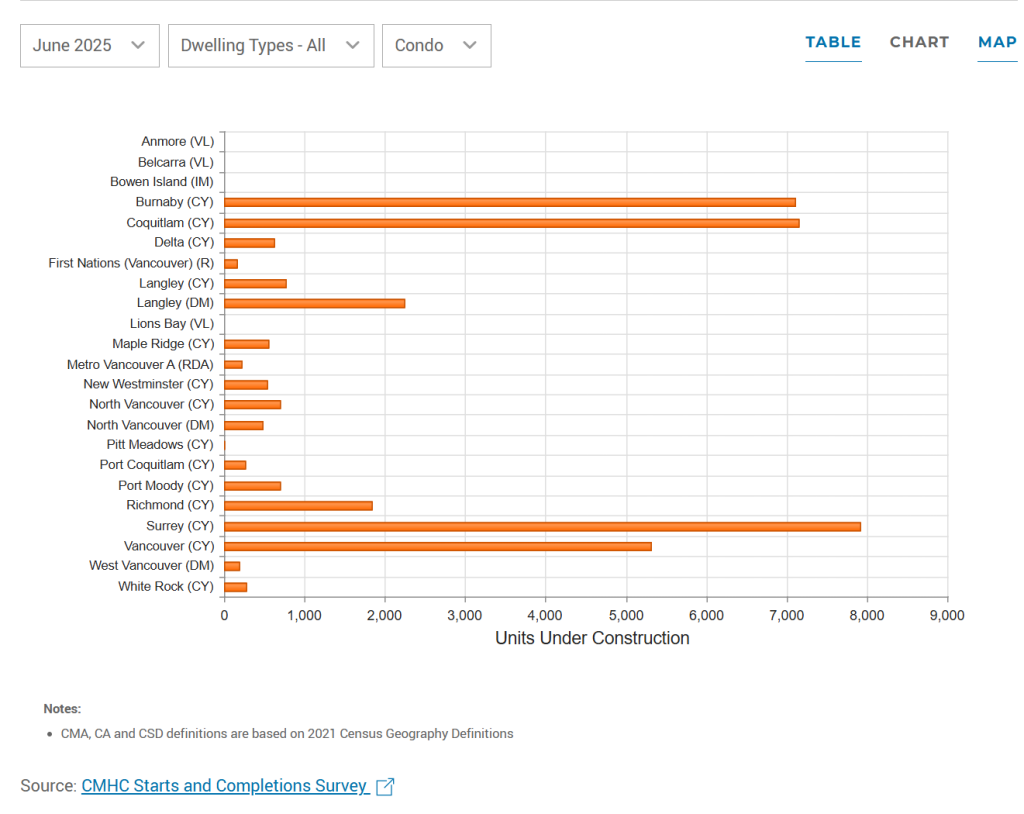

While Burnaby and Coquitlam have exploded in Condos in recent years – especially relative to their populations:

What this means is that despite a weaker than usual demand in the housing sector, both condo and rental supply will continue to complete, and this will likely put downward pressure on rents and prices. The increased length of construction timelines has an impact like the bullwhip effect due to long supply chains.

Divergence between cities/regions.

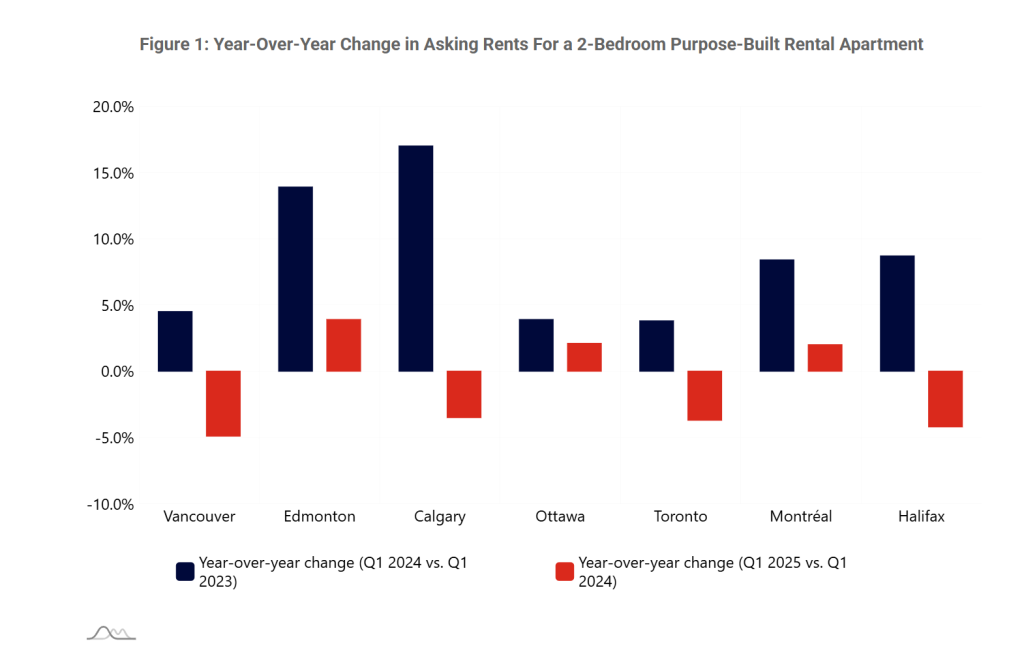

High growth markets of Vancouver, Toronto, Calgary, Halifax have had decreases in asking rents Q1 2025 vs Q1 2024. Other markets have had rate of increase slow.

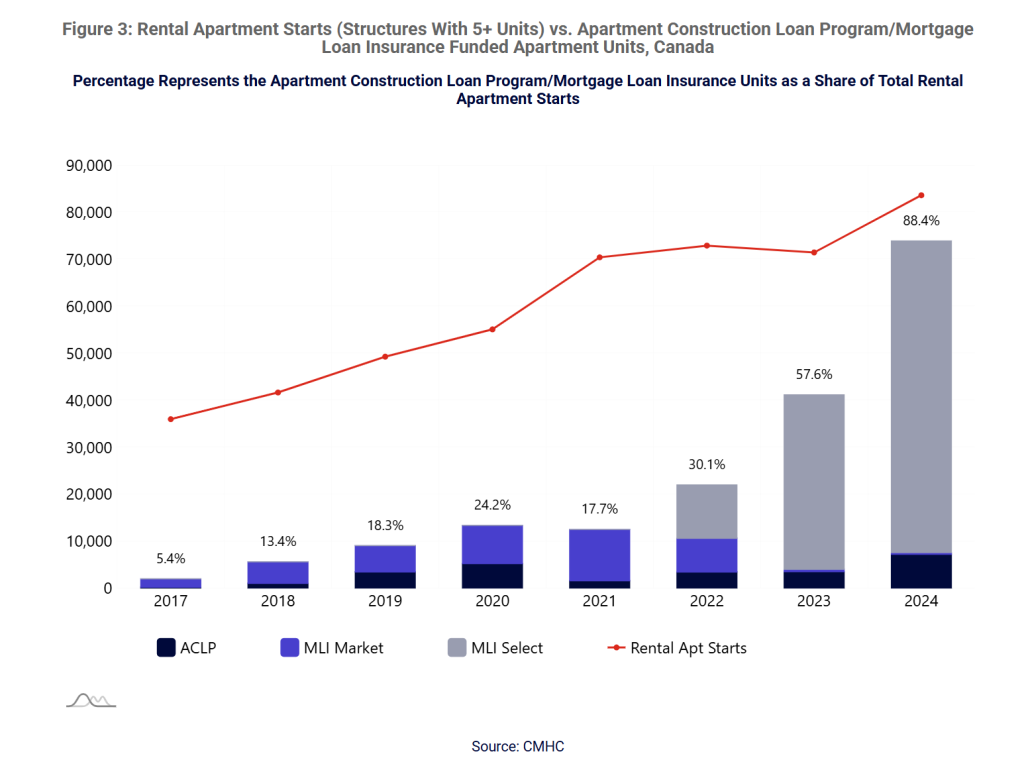

CMHC, specifically MLI select, is now the primary program for rental housing financing in Canada.

The dominance of CMHC shows the success of its MLI Select Product. However, one critique of the program’s scoring lies with how it allocates points on affordability. CMHC uses median renter household income of an area to determine whether the project’s rents are affordable. But this logic is flawed because developers build to the market rate, therefor the program directs additional rental housing to areas that are already affordable relative to incomes, for example Edmonton, as opposed to Vancouver or Toronto. No market rental projects in Vancouver or Toronto can qualify under the affordability metric, yet these are the areas in most need of rental construction financing.

CMHC Rental Development Survey 2025

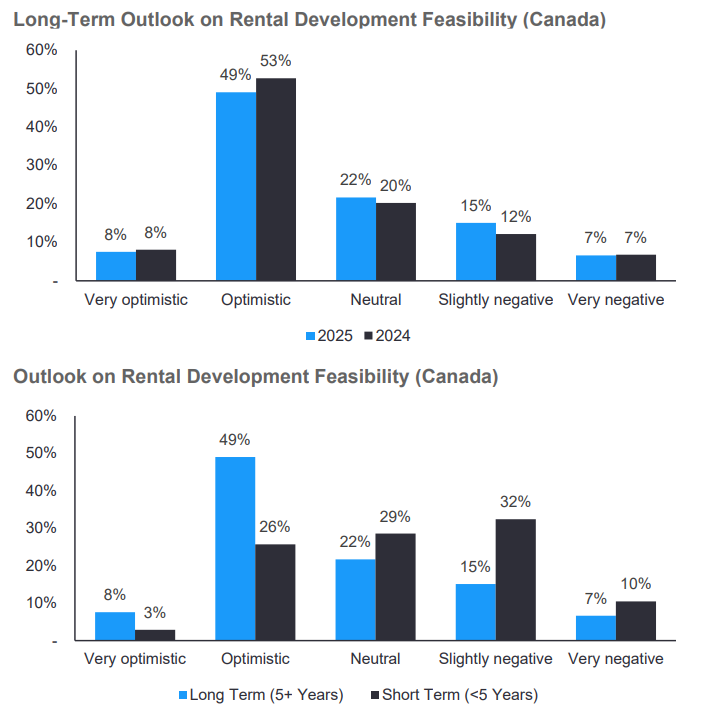

Sentiment among developers, while still positive long term, is for the short term negative (42%) or neutral (29%) vs only 29% optimistic while sentiment has decreased in 2025.

Yardi Canadian National Multifamily Report Q3 2025:

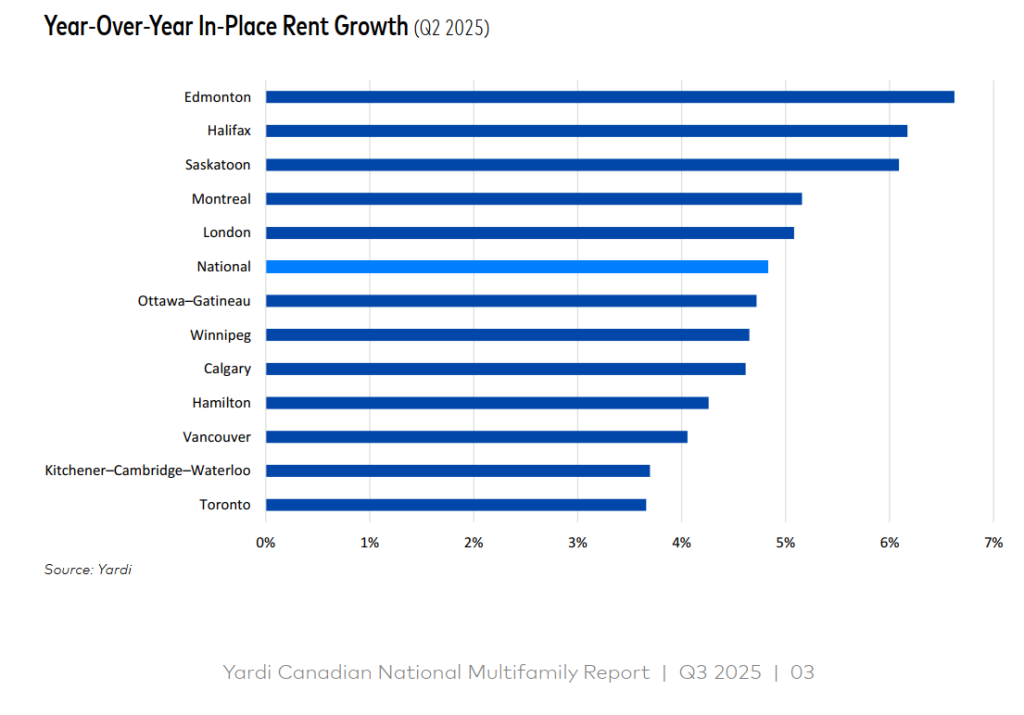

In place rent growth continues across Canada:

While we saw asking rents dip in Vancouver/Toronto year over year, rent control in BC and Ontario has created many below-market tenancies where in-place rents will continue to grow.

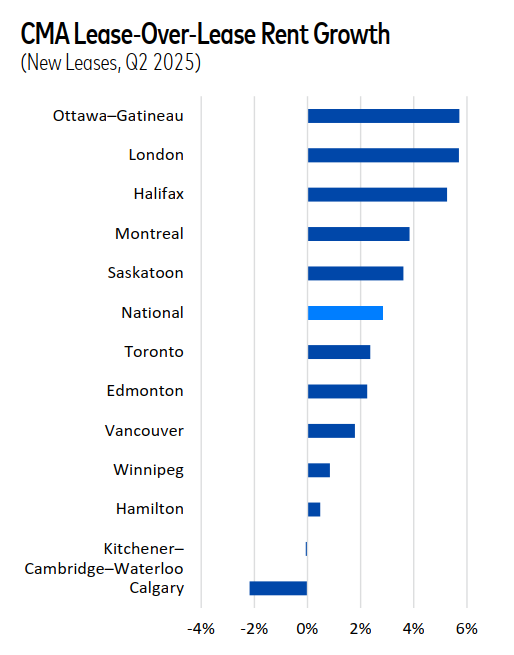

Calgary sees decreasing rents upon turnover and 6.7% vacancy rates:

While some properties in Toronto and Vancouver are probably seeing decreases upon turnover, especially if the departing tenant was newer, there are many others which are bringing rent controlled units to market rents upon turnover. The slight increase blends these 2 scenarios.

Only Calgary saw sustained decreases upon turnover, suggesting either landlords are not efficiently negotiating down their rents to match the market, or that sufficient newer supply is coming to market which tenants are moving into.

Disclosure/Disclaimer:

This blog is published by Habit8 Property Management, licensed property managers in British Columbia. The information provided is for general informational purposes only and does not constitute legal, financial, tax, or other professional advice. While we strive to ensure accuracy, the content reflects our understanding as of the date of publication and may not account for future changes in laws, regulations, or market conditions. You should consult appropriate professionals before making any decisions based on this content.

Get in touch

For more information on rentals: