NewsVancouver’s Tenant Relocation and Protection Plan Analysis Part 1

Analysis Summary:

- Overall costs range between $50,000-$200,000 per tenanted unit in the enhanced TRPP zones which applies to the Broadway Plan and some other areas. This cost varies greatly based on how big the gap is between in-place rents and market rents.

- Vancouver TRPP is a complex policy and can add to administrative burden and cost for developing housing.

- The policy appears to focus on maintaining the status quo for tenants through various compensation mechanisms. While this approach can be perceived as a certain type of fairness, it is also inflexible compared with a simple cash compensation mechanism.

- Vancouver’s inclusionary zoning (IZ) below market rentals is a big subsidy to select tenants, especially in the broadway plan. Although because of the IZ, the broadway plan right of first refusal (ROFR) is less of an incremental cost

- Interaction between tightened provincial rent control and changes to the tenancy act with the city’s TRPP policies has created large windfall subsidies to certain tenants.

The main 3 costs of the policy are:

1. Administrative and one time costs: This includes moving, utilities top-ups, and administrative costs and we estimate this to cost anywhere between $7,000 – $12,000 per unit.

2. Compensation costs: Under standard TRPP – this is based on length of tenancy and existing rent, and the compensation is somewhat inversely related to the in-place/market gap – that is the gap between existing rent and what market rents are (a gap due to rent control). This compensation is between 4-24 months rent and the range could be large if there are tenants who have stayed greater than 20 years but we estimate in most cases to fall between $4,000 – $15,000 per unit.

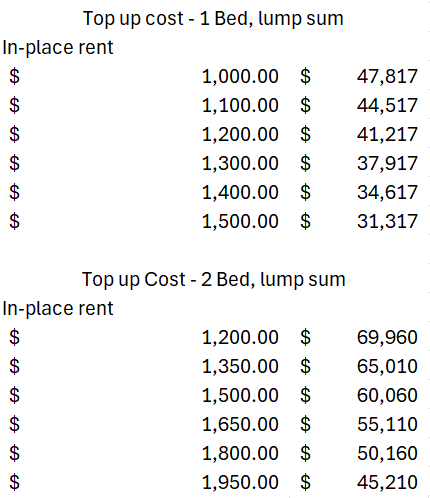

Under Broadway plan TRPP – this is based on gap between in-place rent and the market rent (CMHC new rents), and is directly related to the in-place/market gap. This number is substantially higher and we estimate the cost to be $30,000-$50,000 for 1 bedrooms, and $45,000 – $70,000 for two bedrooms. This is based on the prescribed $2,449 – 1 bed and $3,320 – 2 bed CMHC newer rents rates. These numbers are undiscounted – not adjusted to PV and we assume the prescribed 33 month amount for the lumpsum to be the approximate cost as it is probably the more costly option compared with the developer paying the rent difference. A sensitivity table is below that shows the estimated top-up cost for various levels of in-place rents.

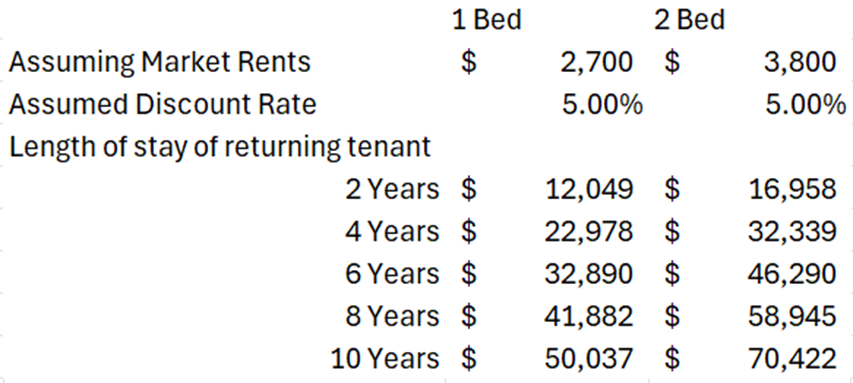

3a. Right of first refusal (ROFR) – Standard TRPP – 20% below new building average:

Biggest factor here is how long a tenant stays after exercising their ROFR. Assuming that the 20% gap between market stays constant, and assuming some rent and discount rate numbers, the ROFR costs between $12,000 – $50,000 for a 1 bed, and $17,000 – $70,000 for a 2 bed. ROFR numbers are adjusted to PV using the indicated discount rate in the table below: Note: capitalizing the 20% discount using prevailing cap rates will probably overestimate the subsidy as it’s unlikely any tenant will stay forever.

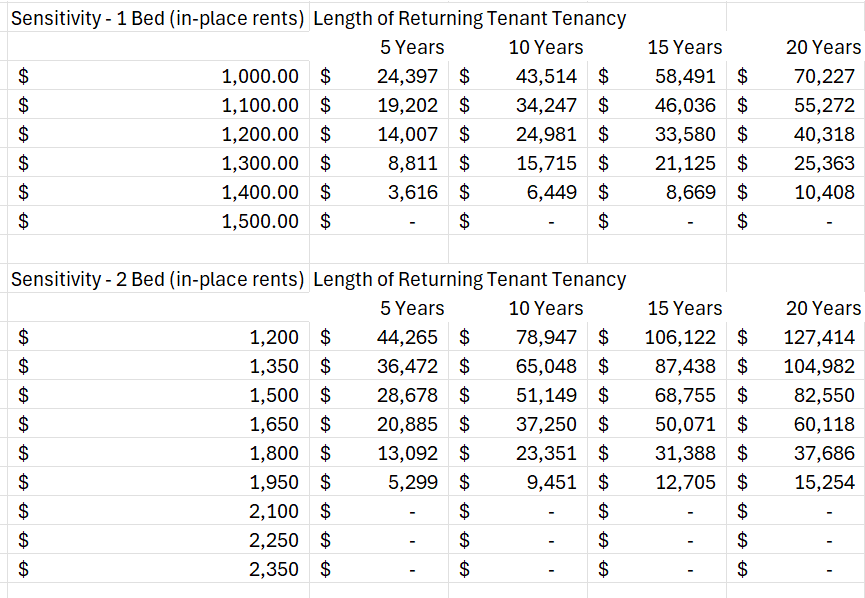

3b. Right of first refusal (ROFR) Broadway TRPP – lower of in-place rent and 20% below CMHC average:

The Broadway TRPP ROFR cost is more nuanced as it looks at the difference between in-place and CMHC average.

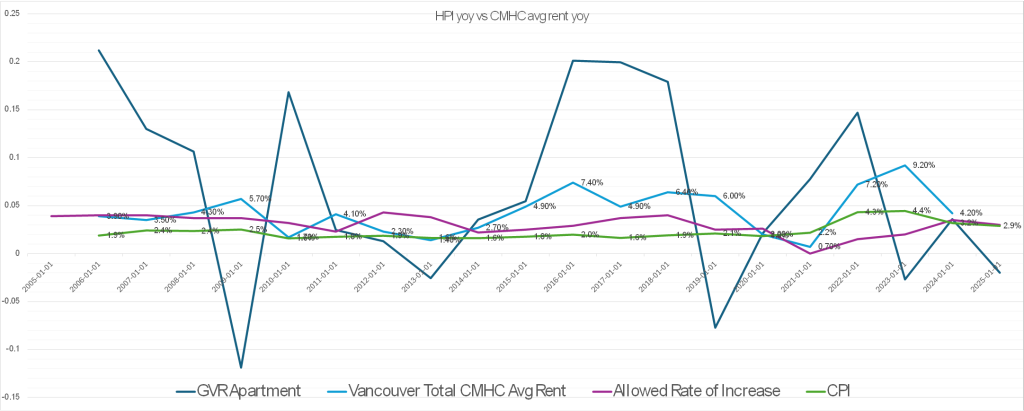

While one can assume that the gap between these two stay constant, we think that the gap will actually diverge and this is due to the construction of the CMHC average rent data. As more older buildings are redeveloped and new rental supply come on, the rental stock will improve and hence will command higher rents on average compared with the counterfactual of no new development. Furthermore, because CMHC surveys actual in place rents, and because of tightened rent control of the previous 5-7 years, there is catch-up room in the CMHC data as units turn over.

We plotted the CMHC Vancouver average rent, the allowed rate of increase and CPI below to show a fairly consistent trend of CMHC average rents outpacing CPI and the allowable increase. This is likely driven by the two factors mentioned above. What’s not shown is the actual market rents due to a lack of good data. But the MLS Index for Vancouver apartments is shown as a proxy of real estate demand.

Because we are assuming that the CMHC average rent will increase faster than market rents or the allowed rate of increase per rent control, the below table is likely an underestimate of the cost of broadway plan ROFR. Note that broadway plan ROFR cost is measured as an additional cost on top of the revenue less due to 20% below market requirement using assumed 5% discount rate. The range for this is large but can easily be $50,000-$100,000 per unit. However, this cost may be able to be reduced by rightsizing some units in the ROFR process according to CMHC occupancy guide.

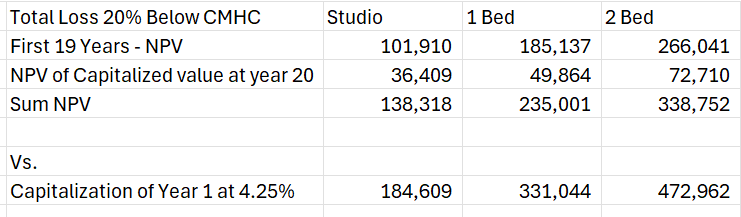

As a side note, we wanted to calculate how much the subsidy of 20% below CMHC average rents was really worth so we did a simple calculation where we assumed that CMHC average rents would growth at 4% while market rents grew at 2.5% over 20 years with CMHC rents catching up to 95% of market rents, and we compared this with a direct capitalization of year 1 gap in rents using 5% discount rate and 4.25% Cap Rate and market rents of $2000 for studio, $2700 for 1 bed, and $3800 for 2 beds. We show that the valuation difference can be $50,000-$150,000, meaning that the 20% below market is likely less worse than first appears. Not to mention that the 20% below market component will have zero vacancy and super consistent rent growth even in down markets.

In the next blog we’ll analyze the results and discuss policy implications.

Disclosure/Disclaimer:

This blog is published by Habit8 Property Management, licensed property managers in British Columbia. The information provided is for general informational purposes only and does not constitute legal, financial, tax, or other professional advice. While we strive to ensure accuracy, the content reflects our understanding as of the date of publication and may not account for future changes in laws, regulations, or market conditions. You should consult appropriate professionals before making any decisions based on this content.

Get in touch

We’re interested in all aspects of the rental market

Contact us to get in touch